Florida Market Update: Homebuyers Gaining Leverage

18

2023U.S. Housing Market Update

Before we dive into our Florida Market Update, let's take a look at some national statistics. With interest rates hovering around 7% and the U.S. median sales price reaching $410,200, the second highest value ever recorded, it is no surprise that single-family home sales dropped 18.8% and condominium sales declined 20% year-over-year in June. According to the National Association of Realtors' Economists' Outlook, housing inventory is down 13.6% compared to last June.

It's clear that the US housing market is experiencing a housing affordability crisis, but economists are at odds over where the market is headed in the near future. Realtor.com chief economist Danielle Hale predicts that housing inventory and home sales will continue to decline this year. Jack Macdowell, chief investment officer of the Palisades Group, shared Hale's sentiment in a recent Forbes article, "Inventory is approximately 46% below the historical average dating back to 1999. We think that it is highly unlikely that the inventory problem will be resolved in 2023.” While NAR chief economist Lawrence Yun acknowledges that home prices will remain high while inventory is low, he is more optimistic, stating that "The recovery has not taken place, but the housing recession is over.”

Despite our affordability crises, there is good news for homebuyers seeking median-priced new construction. As of October 2022, the median sales price for a new home was $497,800, while the median sales price for a resale was $378,800. The difference between the median sales price of new construction and resale homes has since decreased a whopping 96%. In today's market, a buyer purchasing a moderately priced new home can expect to pay around $5,000 more than they would for a resale. If you are looking to purchase new construction, check out these tips for negotiating with developers.

Florida Housing Market Update

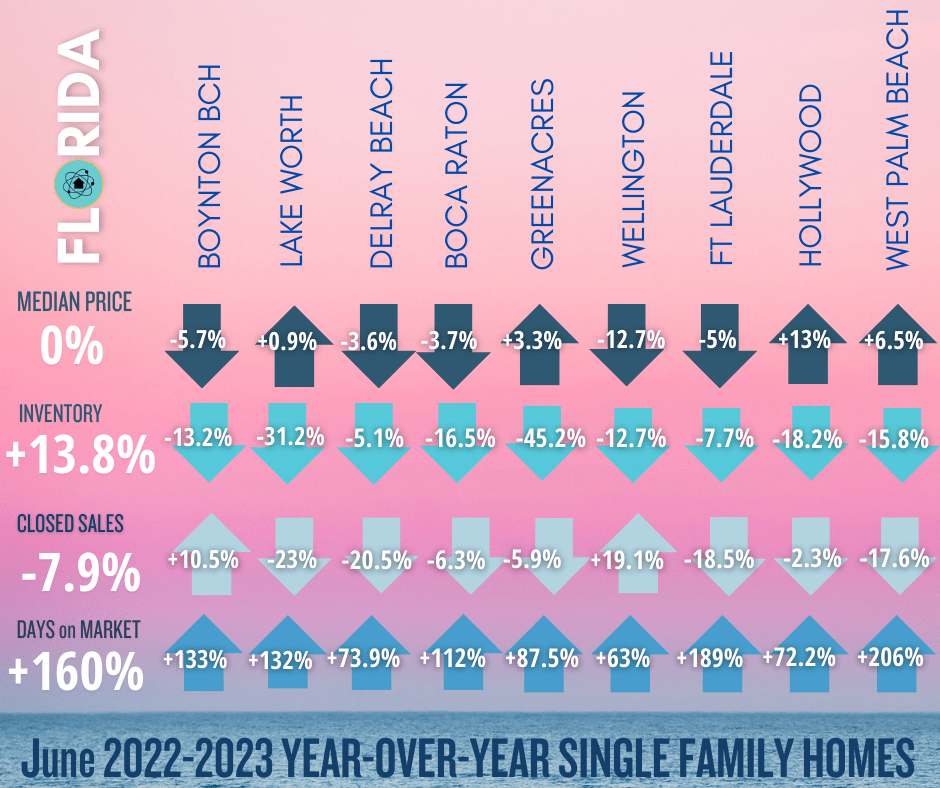

In June of last year, the average interest rate on a 30-year fixed-rate mortgage was 5%; this June, we are hovering between 6.5%-7%. While interest rates are largely to blame for the 7.9% June year-over-year decrease in Florida home sales, it is important to note that closed sales were actually down 32.5% in January. This notable improvement in home sales is a sign that Floridians are growing more accustomed to higher interest rates.

Similarly, after a sharp increase in inventory during mid-2022, new listings slowed in the first half of 2023 because homeowners didn't want to purchase a new home when their current mortgage rates were so much lower than the prevailing rates. Now more Florida home sellers are starting to list their homes because they are realizing that interest rates are not likely to come down significantly in the near future. Therefore, single-family housing inventory increased year-over-year by 13.8% for single-family homes and 40.5% for condos and townhomes in The Sunshine State. Increasing inventory is leading to prices moderating, with the year-over-year median sales price unchanged from last June.

South Florida Market Update

While housing inventory increased year-over-year in Florida, the Miami-Fort Lauderdale-West Palm Beach MSA saw a 4.2% year-over-year decrease in June. Some South Florida cities are still experiencing significant inventory declines, such as Lake Worth (-31.2%), Greenacres (45.2%), and Hollywood (-18.2%). Despite this low inventory, sellers are not enjoying the bidding wars that have been so prevalent over the past few years. With interest rates hovering around 7%, there are far fewer buyers competing to purchase homes.

The white-hot seller's market in South Florida is cooling. Homes are taking much longer to sell. The median days on the market increased year-over-year by 76.9% in the Miami-Fort Lauderdale-West Palm Beach MSA. In some South Florida cities, the median days on the market have increased year-over-year by triple digits. This is the case in Boynton Beach (+133%), Fort Lauderdale (+189%), and West Palm Beach (+206%).

This is encouraging news for South Florida homebuyers. If a buyer has not been squeezed out of the market by rising interest rates and high sales prices, they will actually have some leverage when purchasing a home. In the very recent past, South Florida homebuyers were paying well above asking while offering sellers major concessions in order to win in multiple offer situations. In today's South Florida Housing Market, buyers have greater negotiating power because sellers are far less likely to have multiple offers on the table. If you are actively looking at property, pay close attention to a listing's days on the market and the sales price history. If a home has been sitting on the market and the list price has been reduced over time, you are likely in a good position to negotiate the home purchase.

Hometown Heros Program

If you are considering a Florida home purchase and could use assistance with your down payment and closing costs, you will be happy to know that the Hometown Heros Program has been expanded. Florida's Hometown Heros Program was originally designed to assist homebuyers in the medical field, law enforcement, and education. As of July 2023, it is being offered to first-time homebuyers with a minimum credit score of 640 who work full-time for a Florida-based company and earn less than 150% of their county's area median income (AMI).

Eligible homebuyers can borrow up to $35,000 to cover closing costs and down payments in the form of a 30-year deferred second mortgage. While the Florida Hometown Heros loan is not forgivable, it is a non-amortizing 0% loan with no minimum monthly payments. This second mortgage does become due when you sell the property, refinance your first mortgage, or when the home is no longer your primary residence.

With home prices and interest rates so high, many homebuyers are being stretched to their limits. Real-ativity has compiled a comprehensive list of down payment assistance programs and options to help Floridians achieve their dreams of homeownership. If you would like to discuss your options in greater detail, please call our broker, Elizabeth Lewis, at (561) 512-4682.